Get the free format of form 15cb in word

Show details

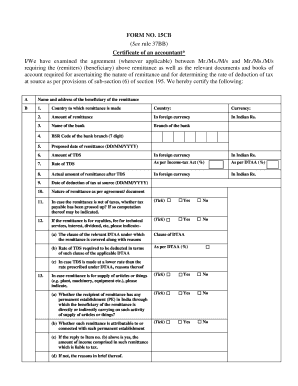

Form No. 15CB (See rule 37BB) Certificate of an accountant1 I/We* have examined the agreement (wherever applicable) between Mr./Ms./M/s*????????????. And Mr./Ms./M/s*?????????????.. (Remitters) (Beneficiary)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 15ca download in word format

Edit your 15cb word format form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 15cb format in word form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 15ca and 15cb in word format online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 15ca word. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 15cb download in word format

How to fill out Form 15CB

01

Obtain Form 15CB from the official website or from the income tax department.

02

Fill in the details of the applicant, including name, address, and PAN (Permanent Account Number).

03

Provide the details of the foreign remittance, including the amount, currency, and purpose of the remittance.

04

Mention the applicable tax rate and the income head under which the foreign income falls.

05

Ensure to mention if any tax has already been paid on the remittance amount.

06

Affix the professional signature and seal of the Chartered Accountant (CA) who is verifying the form.

07

Submit the completed Form 15CB to the authorized bank or financial institution handling the remittance.

Who needs Form 15CB?

01

Form 15CB is required by individuals or entities making foreign remittances in India who need to certify that the applicable tax has been paid or that the remittance is not taxable in India.

02

It is typically needed by individuals, businesses, and professionals who are sending money abroad for purposes such as investment, payments for services, or gifts.

Video instructions and help with filling out and completing format of form 15cb in word

Instructions and Help about form 15cb filled sample

Music 6 b was trained

Fill

fillable form 15ca

: Try Risk Free

People Also Ask about 15 ca cb form

How to file Form 15CA offline utility?

Step 1: Click the Form 15CA option. Step 2: The General Instructions is provided in the Utility. Step 3: Choose the Part you want to fill from the dropdown and click Continue. Step 4: Fill details on the remitter, remittee and remittance details.

How can I download Form 15CA?

Navigate to “e-File” menu and select View Form 15CA Offline/Bulk menu under View Income Tax Forms sub-menu.

How do I manually submit Form 15CA?

Step 1 Fill Form 15CA in the downloaded offline utility for Forms submitted manually earlier and generate xml(s). The xml(s) to be zipped in a folder. Step 3 Navigate to menu >> e-file >> Income-tax Forms >> File Income-tax Forms and select Form 15CA. Select “Manual” radio button and click on the continue button.

How do I manually file Form 15CA?

Navigate to menu >> e-file >> Income-tax Forms >> File Income-tax Forms and select Form 15CA. Select “Manual” radio button and click on the continue button. Upload zipped file under “Attach File” option in “Upload Manual Bulk Form” menu and submit using prescribed modes of e-verification.

How do I manually File Form 15CA and 15CB?

How to File Form 15CA and 15CB? Login to the e-Filing portal. Login to the e-Filing portal using valid credentials. File Income Tax Forms. Click on e-File > Income Tax Forms > File Income Tax Forms. Search Form 15CA or 15CB. Enter the required details. e-Verify the Form. Successful verification.

How can I upload my 15CA form online?

Step 3 Navigate to menu >> e-file >> Income-tax Forms >> File Income-tax Forms and select Form 15CA. Select “Manual” radio button and click on the continue button. Step 4 Upload zipped file under “Attach File” option in “Upload Manual Bulk Form” menu and submit using prescribed modes of e-verification.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 15ca download in?

Form 15CA is a form required to be filled by an individual or a company who is making a payment to a non-resident. This form is required to be filled and submitted online to the Income tax department. The purpose of this form is to provide information about the payment being made to the non-resident and to determine if any taxes are due on the payment.

Who is required to file form 15ca download in?

Form 15CA is required to be downloaded and filed by all individuals and entities making payments to a non-resident or a foreign company. This form is used to report to the income tax department all payments made to a non-resident or a foreign company, and is applicable for payments of more than Rs. 50,000.

How to fill out form 15ca download in?

1. Go to the website of the Indian Department of Revenue.

2. Download the Form 15CA from the website.

3. Open the downloaded form in a PDF reader.

4. Enter all the required information in the form, such as the name of the remitter, the purpose of the remittance, etc.

5. Attach the necessary documents, such as PAN card, and other documents related to the remittance.

6. Double-check the form and make sure all the details are correct.

7. Submit the form to the relevant authority.

What is the purpose of form 15ca download in?

Form 15CA download is an online form used by those who are making certain types of payments to non-residents. This form is used to ensure that the recipient of the payment is not a resident of India and that the payment does not violate Indian tax laws. The form requires the payer to provide information about the nature of the payment, the recipient, and the amount. The information provided in Form 15CA must be reported to the Indian income tax authorities when the payment is made.

What information must be reported on form 15ca download in?

Form 15CA is an electronic format for furnishing information involved in payments made to non-residents. The following information needs to be reported on Form 15CA for specific nature of transactions:

1. Remittances for imports: Details of the importer and exporter, the import license number, the invoice number, the date, and amount of payment to be made.

2. Payments for exports: Details of the exporter and importer, invoice number, the date, and amount of payment received.

3. Remittances for interest on loans: Details of the borrower and lender, loan agreement, the interest amount payable, and the duration of the loan.

4. Remittances for royalty payments: Details of the payer and the payee, the agreement or contract providing for royalty payment, the amount and nature of royalty payment.

5. Remittances for technical service fees: Details of the payer and the payee, the agreement or contract providing for technical services, the amount and nature of fees payable.

6. Remittances for dividends: Details of the payer and the payee, the agreement or contract providing for dividend payment, the amount and nature of the dividend.

It is essential to provide accurate and complete information as per the specified nature of transactions to comply with reporting requirements.

How can I manage my form 15cb in word format directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your form 15ca in word as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I create an electronic signature for signing my form 15ca format in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your form 15ca word format download and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I complete form 15 ca cb on an Android device?

Use the pdfFiller app for Android to finish your form 15ca and 15cb download. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is Form 15CB?

Form 15CB is a certificate issued by a Chartered Accountant (CA) in India that certifies the nature of income and the tax deducted at source (TDS) for payments made to non-residents.

Who is required to file Form 15CB?

Form 15CB is required to be filed by the taxpayer making a payment to a non-resident, particularly when the payment exceeds specified limits and is subject to tax in India.

How to fill out Form 15CB?

To fill out Form 15CB, the taxpayer must provide details such as the nature of remittance, amount, and the applicable TDS rate, along with the CA's signature and details confirming the compliance with tax laws.

What is the purpose of Form 15CB?

The purpose of Form 15CB is to ensure that the correct amount of TDS is deducted on payments to non-residents and to facilitate compliance with tax laws in India.

What information must be reported on Form 15CB?

Form 15CB must report information such as the nature of income, the amount remitted, the TDS rate, and details of the non-resident recipient including their tax residency status.

Fill out your Form 15CB online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 15ca Cb In Word Format is not the form you're looking for?Search for another form here.

Keywords relevant to 15ca cb form

Related to fillable 15cb form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.