Get the free p60 ireland

Get, Create, Make and Sign p60 pdf download form

Editing form p60 download online

How to fill out form p60 pdf

How to fill out IE Form P60 Laser

Who needs IE Form P60 Laser?

Video instructions and help with filling out and completing p60 ireland

Instructions and Help about p60 download

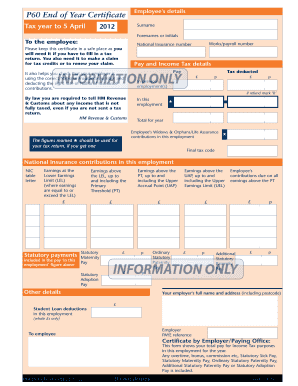

Hi I'm John O'Connor from red oak and welcome to the first video in our tax essential series in these videos I'll be explaining some basic concepts of PA ye tax so to start let's take a look at that most important of tax documents the p60 if you're an employee of a company you'll get a page 60 at the end of the calendar year most companies will hand these out during January or February at the end of the year every company has to give revenue details of the wages they paid you including all the deductions that were made the P 60 is your copy of this information it also gives little information on how your employer calculated your taxes let's take a look at a p60 to see first the P 60 confirms your information your name and PPS sometimes number your address down below it also confirms your employer name and their revenue ID next we find out about your pay section a here outlines the amount to pay used to calculate your income tax charge section D tells us the amount of pay which is used to calculate your USC or the universal social charge these amounts are often the same however in some cases the pay for USC purposes is higher this could be due to a number of reasons for example you're charged USC on pension contributions, but you are not charged income tax on pension contributions you can find out more about the different types of income and what they mean in our calculation of income tax and calculation of you see videos as you know your employer also deducts a range of taxes from your wages to give to revenue information on these tax deductions are also given in the p60 there are four categories of deductions from your wages on the p60 these are income tax the local property tax or the LET your USC charge and of course PRS i which is pay related social insurance lastly it gives some information on how the employer calculated your tax liabilities here they have the tax credits and the rate band used for the income tax calculation and here they have the USC band cut-offs used for calculating the USC charge these are important when we look at calculations in future videos, so that's a quick snapshot of what the p60 is all about I hope you found it helpful find out more about your tax essentials by visiting our website red ope, and thanks for being here you

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ireland form p60?

Who is required to file ireland form p60?

How to fill out ireland form p60?

What is the purpose of ireland form p60?

What information must be reported on ireland form p60?

How can I get how to get p60 online ireland?

How do I complete irish p60 online?

Can I sign the hmrc p60 forms form electronically in Chrome?

What is IE Form P60 Laser?

Who is required to file IE Form P60 Laser?

How to fill out IE Form P60 Laser?

What is the purpose of IE Form P60 Laser?

What information must be reported on IE Form P60 Laser?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.