KE Form TCC 1 2011-2025 free printable template

Show details

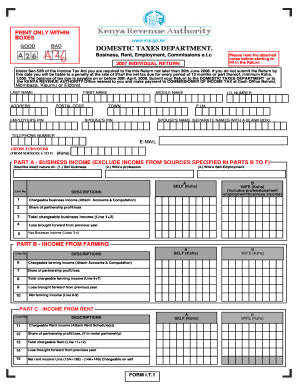

ISO 9001 2008 CERTIFIED TAX COMPLIANCE CERTIFICATE APPLICATION FORM Tick against type of clearance required 1 BIDDERS FOR PUBLIC TENDERS 2 LIQUOR LICENSING 3 CUSTOMS CLEARING AGENTS 4 IMMIGRATION CLEARANCE LETTER 6 FOREIGN ARTISTS PERFORMANCE CERITIFICATE 7 REGISTRATION OF TRAILERS NAME OF APPLICANT. POSTAL PHYSICAL ADDRESS. TELEPHONE NO. PERSONAL IDENTIFICATION NUMBER PIN. NATURE OF BUSINESS. TYPE OF BUSINESS COMPANY No DETAILS OF PARTNERS/DIRECTORS PIN PARTNERSHIP NAME PINs OF ASSOCIATED...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign kenya tax form

Edit your kra certificate application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax compliance certificate kra form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit certificate application form online

To use the services of a skilled PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax certificate form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out compliance certificate application form

How to fill out KE Form TCC 1

01

Obtain the KE Form TCC 1 from the relevant tax authority's website or office.

02

Begin filling out the taxpayer information section with your name, address, and Tax Identification Number (TIN).

03

Indicate the type of tax compliance certificate you are applying for.

04

Provide details of any past tax payments or outstanding liabilities if required.

05

Attach any necessary supporting documents, such as proof of tax payment or previous tax returns.

06

Review the completed form for accuracy and completeness.

07

Submit the form either online or in person at the designated tax authority office.

08

Keep a copy of the submitted form and any confirmation for your records.

Who needs KE Form TCC 1?

01

Individuals or businesses seeking a tax compliance certificate for legal or official purposes.

02

Taxpayers applying for certain licenses or permits that require proof of tax compliance.

03

Entities needing to provide documentation to banks or financial institutions for loan applications.

Video instructions and help with filling out and completing compliance certificate kra

Instructions and Help about kra clearance certificate

Fill

kra tcc form

: Try Risk Free

People Also Ask about kra tax compliance certificate download

How do I get a KRA clearance certificate?

Application for a TCC is done through iTax platform and the certificate is sent to applicants' email address. You can now check if your Tax Compliance Certificate is valid using the new KRA M-Service App.

How long does it take to get tax compliance certificate in Kenya?

Usually, Tax Compliance is issued within a period of 5 days ing to KRA service charter; however, it may be issued before. It's always important to follow up on your application at your Tax Station for faster processing of your application.

Can I still print a tax clearance certificate?

Once you have generated a TCS PIN, you can still print a Tax Clearance Certificate.

What is the importance of KRA?

The overall mandate of KRA is to assess, collect and account for all tax revenues in ance with the written laws and the specified provisions of the written laws.

How do I download my KRA clearance certificate?

How To Download KRA Clearance Certificate Step 1: Visit KRA Portal. Step 2: Enter KRA PIN Number. Step 3: Enter KRA Password and Solve Arithmetic Question (Security Stamp) Step 4: KRA Portal Account Dashboard.

How do I access my tax clearance?

How to access the eTC service. If you are registered for myAccount, click 'Tax Clearance' on the 'Manage My Record' card. If you are registered for Revenue Online Service (ROS), this service is available by clicking on either: the 'Manage Tax Clearance' tab, under the 'My Services' section on your ROS home screen.

How long does it take for KRA?

Successful applicants will receive email with the TCC attached within 5 working days, whereas unsuccessful applicants will be notified of the areas of non compliance.

How much does it cost to apply for KRA?

The total Cost of KRA PIN Registration is Kshs. 200/= only. Place your order online and get your KRA PIN in 5 minutes via email address today.

How long does it take to get KRA certificate?

Residents receive their PIN Certificate instantly after completing the online registration form. Non-residents receive an acknowledgement receipt which they should present to Times Tower, alongside other relevant documents, to complete their registration process.

What is KRA certificate?

A Tax Compliance Certificate is an official document issued by KRA as proof that the bearer is filing returns and paying taxes. The certificate is issued to an individual or a company.

Can I download a tax clearance certificate online?

With the introduction of the new tax compliance status system, one can now print a tax clearance certificate online. Once a successful application has been done via SARS efiling, the system will generate a valid tax clearance certificate for the use by the tax payer.

How do I get a NJ tax clearance certificate?

Individuals require a paper application The Application for Business Assistance Tax Clearance must be completed, signed by the applicant, and submitted to the Division of Taxation, at the address listed on the application. Payment must be made by check or money order.

How do I get a KRA certificate?

How to Register Visit itax.kra.go.ke. Select "New PIN Registration" Select "Non-Individual" and "Online Form" as your mode of registration. Fill in your basic information. Select suitable tax obligation by checking the relevant boxes. Enter details of company directors or partners. Fill in agent details if you have one.

How do I get my KRA certificate?

How to Register Visit itax.kra.go.ke. Select "New PIN Registration" Select "Non-Individual" and "Online Form" as your mode of registration. Fill in your basic information. Select suitable tax obligation by checking the relevant boxes. Enter details of company directors or partners. Fill in agent details if you have one.

How long does it take to get KRA PIN certificate?

Residents receive their PIN Certificate instantly after completing the online registration form. Non-residents receive an acknowledgement receipt which they should present to Times Tower, alongside other relevant documents, to complete their registration process.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my income tax clearance certificate directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your how to get kra clearance certificate online and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Where do I find kra certificate download?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific clearance form and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit how to get kra clearance certificate on an Android device?

The pdfFiller app for Android allows you to edit PDF files like tax compliance certificate sample. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is KE Form TCC 1?

KE Form TCC 1 is a tax compliance certificate form used in Kazakhstan to confirm that an individual or entity has fulfilled their tax obligations.

Who is required to file KE Form TCC 1?

Individuals and legal entities who are seeking to verify their tax compliance status in Kazakhstan are required to file KE Form TCC 1.

How to fill out KE Form TCC 1?

To fill out KE Form TCC 1, applicants need to provide personal or business identification details, tax identification number, and any relevant financial information, then submit it to the tax authority.

What is the purpose of KE Form TCC 1?

The purpose of KE Form TCC 1 is to provide proof of tax compliance for individuals or entities, which may be necessary for various administrative or financial processes.

What information must be reported on KE Form TCC 1?

Information that must be reported on KE Form TCC 1 includes taxpayer identification details, tax compliance status, and any relevant financial data to demonstrate tax obligations have been met.

Fill out your KE Form TCC 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Compliance Certificate Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to kra clearance certificate sample

Related to how to download your kra pin certificate

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.