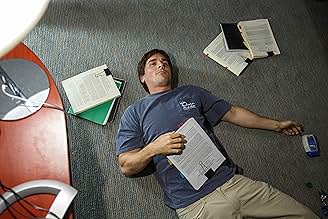

Christian Bale credited as playing...

Michael Burry

- Michael Burry: I met my wife on match.com. My profile said that I'm a medical student with only one eye, an awkward social manner, and 145 thousand dollars in student loans. She wrote back, "You're just what I've been looking for!" She meant honest.

- Lawrence Fields: Your big mortgage bet concerns us. We have no confidence in your ability to identify macroeconomic trends.

- Michael Burry: You flew here to tell me that? Why? I mean, anyone can see there's a real estate bubble.

- Lawrence Fields: Actually, no one can see a bubble. That's what makes it a bubble.

- Michael Burry: That's dumb, Lawrence. There are always markers. Mortgage fraud - it's quadrupled since 2000. Average take home pay is flat yet home prices are soaring. That means homes are debts not assets.

- Martin Blaine: [sarcastically] So Mike Burry of San Jose, a guy who gets his hair cut at SuperCuts, and doesn't wear shoes, knows more than Alan Greenspan and Hank Paulson?

- Michael Burry: Dr. Mike Burry. And yes... he does.

- Michael Burry: It's only a matter of time before someone else sees this investment. We have to act now.

- Lawrence Fields: And how do you know these bonds are built on subprime crap? Aren't they filled with hundreds of pages of mortgages?

- Michael Burry: I read them.

- Lawrence Fields: You read them? No one reads them. Only the lawyers who put them together read them.

- Michael Burry: I don't think they even know what they made. The whole housing market is propped up on these bad loans. It's a time bomb, and I want to short it.

- Lawrence Fields: Through what instrument, Michael? There are no insurance contracts or options for mortgage bonds! The bonds are too stable. No one would buy them.

- Michael Burry: I'm going to get a bank to make me one. Then I'm going to buy a ton of them.

- Lawrence Fields: Are you being sarcastic with us, Mike?

- Michael Burry: Lawrence, I don't know how to be sarcastic.

- Michael Burry: I want to buy swaps on mortgage bonds. A credit default swap that pays off if the underlying bond fails.

- Goldman Sachs Sales Rep (Lucy): You want to bet against the housing market?

- Michael Burry: Yes.

- Goldman Sachs Quant (Deeb): Why? Those bonds only fail if millions of Americans don't pay their mortgages. That's never happened in history. If you'll forgive me, Dr. Burry, it seems like a foolish investment.

- Michael Burry: Well, based on prevailing sentiment, the market, the banks and popular culture, yes, it's a foolish investment. But, everyone's wrong.

- Goldman Sachs Sales Rep (Lucy): This is Wall Street, Dr. Burry. If you offer us free money, we ARE going to take it...

- Michael Burry: [interrupts her] My one concern is that when the bonds fail I want to be certain of payment in case of solvency issues with your bank.

- Goldman Sachs Sales Rep (Lucy): I'm sorry, are you for real? You want to bet against the housing market and you're worried WE won't pay YOU?

- Goldman Sachs Quant (Deeb): [confers, whispering with colleage, in a lengthy sidebar] Dr. Burry, we could work out a pay-as-we-go structure that would pay out if the bonds fail. But it would also apply to your payments if the value of the mortgage bond goes up, You'd have to pay us monthly premiums.

- Goldman Sachs Sales Rep (Lucy): Is that acceptable, Dr. Burry?

- Michael Burry: Yes... yes. I have prospectuses on the six mortgage-backed securities I want to short.

- Goldman Sachs Quant (Deeb): [Lengthy silence as the Goldman reps scan and review the thick booklets] Dr. Burry, these should be fine.

- Goldman Sachs Sales Rep (Lucy): We're prepared to sell you five million in credit default swaps on these mortgage bonds.

- Michael Burry: Could we make it a hundred million?

- Lawrence Fields: How big is your short position right now?

- Michael Burry: Uhh... 1.3 billion.

- Lawrence Fields: And the premiums?

- Michael Burry: Well, we pay roughly 80 to 90 million each year, which is high but I was the first to do this trade. Watch, it will pay. I may have been early, but I'm not wrong.

- Michael Burry: Lawrence, I found something really interesting.

- Lawrence Fields: Great, Michael. Whenever you find something interesting, we all tend to make money. What stock are you valuing?

- Michael Burry: No stocks. I want to short the housing market.

- Michael Burry: The fact is these mortgage-backed securities are filled with extremely risky subprime adjustable-rate loans. And when the majority of the adjustable rates kick in in '07, they will begin to fail, and if they fail above 15%, the whole bond is worthless.