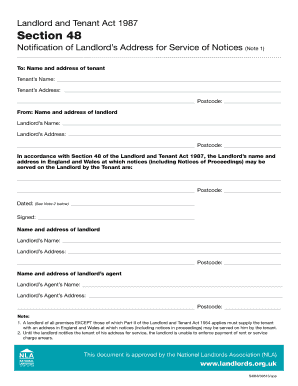

UK NLA Notification of Landlords Address for Service of Notices 2018-2024 free printable template

Show details

Notification by landlord of address for service of notices.

Landlord and Tenant Act 1987 section 48To:

Tenants name: Tenants address: Postcode: In accordance with Section 48 of the Landlord and Tenant

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign section 48 notice template form

Edit your section 48 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your section 48 template 2018-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing section 48 template 2018-2024 online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit section 48 template 2018-2024. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

UK NLA Notification of Landlords Address for Service of Notices Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out section 48 template 2018-2024

How to fill out section 48

01

To fill out section 48, you can follow these steps:

02

Start by reading the instructions for section 48 carefully.

03

Gather all the necessary information and documents required to fill out the section.

04

Begin by providing your personal details in the designated fields, such as your name, address, and contact information.

05

Continue by answering the questions or providing the requested information in each section as accurately as possible.

06

Double-check your entries to ensure they are correct and complete.

07

If required, attach any supporting documents or evidence to support the information provided in the section.

08

Review the filled-out section 48 to ensure everything is filled correctly.

09

Sign and date the section, as required.

10

Submit the completed section 48 along with the rest of the required forms or documents as instructed.

11

Keep a copy of the filled-out section and any accompanying documents for your records.

Who needs section 48?

01

Section 48 is typically needed by individuals or entities who are filling out a specific form or document that requires this section.

02

Examples of who may need section 48 include:

03

- Applicants for a particular job or position that asks for section 48 to be completed.

04

- Individuals applying for a license or permit that requires section 48.

05

- Participants in a program or event that mandates the completion of section 48.

06

- Anyone completing a form or document where section 48 is indicated as a required section.

07

The specific requirements or circumstances that necessitate section 48 may vary depending on the form or document being filled out.

Fill form : Try Risk Free

People Also Ask about

How much is the investment tax credit?

The Investment Tax Credit (ITC) is currently a 30 percent federal tax credit claimed against the tax liability of residential (under Section 25D) and commercial and utility (under Section 48) investors in solar energy property.

What is an example of an investment tax credit?

Effect on taxes As with all tax credits, the investment tax credit reduces your tax liability on a dollar-for-dollar basis. For example, if you owe the IRS $3,000 and claim an investment tax credit of $1,000, your tax liability drops to $2,000 ($3,000 taxes you owed - $1,000 of tax credit = $2,000 total taxes owed).

What is Section 48 of the IRA?

Section 48(e)(4) directs the Secretary of the Treasury or her delegate (Secretary) to establish a program, within 180 days of enactment of the IRA, to allocate amounts of Capacity Limitation to qualified solar and wind facilities. Low-Income Communities Bonus Credit Program for calendar years after 2024.

What is the investment tax credit?

Investment tax credits are basically a federal tax incentive for business investment. They let individuals or businesses deduct a certain percentage of investment costs from their taxes. These credits are in addition to normal allowances for depreciation.

What is the new investment tax credit?

Investment Tax Credit (ITC) Inflation Reduction Act extended the ITC from 2022 through 2032 as a 30 percent credit for qualified expenditures. It then drops to 26 percent for systems installed in 20 2033 and 22 percent those installed in 2034 before it it is eliminated to 0% in 2035.

What is the 30 percent investment tax credit?

At 30%, the tax credit is worth $7,500 for a $25,000 solar system — effectively knocking the price down to $17,500. The credit was previously at 26% for systems installed in 2022 and scheduled to step down to 22% in 2023 before going away entirely in 2024.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is section 48?

Section 48 can refer to different things depending on the context:

1. Education Act 1996: In the UK, Section 48 of the Education Act 1996 requires educational institutions to undergo "denominational inspection" if they are religiously affiliated. This inspection evaluates the religious character and religious education of the institution.

2. Immigration and Nationality Act of 1952: In the United States, Section 48 of the Immigration and Nationality Act of 1952 pertains to the criteria and procedures for deportation of non-citizens who have committed certain criminal offenses.

3. Section 48 of the Internal Revenue Code: In the United States, Section 48 of the Internal Revenue Code refers to a tax credit for energy-related investments.

Without more specific context, it is difficult to determine which Section 48 is being referred to.

Who is required to file section 48?

Section 48 of what? Please provide more specific information so that I can assist you better.

How to fill out section 48?

Section 48 typically refers to a specific section on a form or document, so it would help to provide more context or clarify the type of form you are referring to. However, here are some general steps to consider when filling out a section on a form:

1. Read the instructions: Familiarize yourself with the instructions, guidelines, or any accompanying notes provided to ensure you understand what is required in Section 48.

2. Gather necessary information: Collect all the relevant information you need to complete the section. This may include personal details, dates, addresses, or any other specific details mentioned in the instructions.

3. Follow the format: Pay attention to the requested format or style for filling out the section. Some sections might require dates in a certain order or specific ways of writing addresses. Make sure you comply with these specifications.

4. Provide accurate information: Fill out the section with accurate and up-to-date information. Double-check the details before submitting to avoid any mistakes or errors.

5. Be concise and clear: Some sections might have limited space or require succinct answers. Make sure your responses are concise while still providing the required information. If needed, attach additional documents or use supplementary pages, if allowed.

6. Sign and date: If required, sign and date the section. This is usually necessary for legal or formal documents. Ensure your signature and date are legible and placed in the designated spaces.

7. Review and proofread: Before submitting, review the entire form including Section 48 for any errors, missing information, or inconsistencies. Proofread your responses to ensure accuracy and clarity.

8. Keep a copy: Make a copy of the completed form for your records before submitting (if applicable). This can serve as a reference or provide proof of what you submitted.

Remember, the specific instructions or requirements for filling out Section 48 may vary depending on the form or document you are dealing with. It's crucial to refer to the instructions provided with the form and adhere to any additional guidelines or policies.

What is the purpose of section 48?

Section 48 refers to a specific provision in the Mental Health Act of 1983 in the United Kingdom. The purpose of Section 48 is to outline the process through which a person who is detained under the Act can be transferred or received between different hospitals or healthcare facilities for psychiatric treatment. It sets out the necessary legal requirements, criteria, and procedures involved in such transfers, ensuring that individuals receive appropriate care in the most suitable location. The section provides safeguards to protect the rights and well-being of the individual, ensuring that any transfer is necessary and in their best interests.

What information must be reported on section 48?

Section 48 typically refers to a specific section of a document, form, or report, so the specific information that must be reported in Section 48 depends on the context. It is important to know the context or nature of the document or form being referred to in order to accurately answer what information must be reported in that specific section. Please provide more details or clarify the context to get a more specific answer.

What is the penalty for the late filing of section 48?

Section 48 refers to the late filing of an individual tax return in the United Kingdom. The penalty for late filing of section 48 depends on the specific circumstances and the amount of time that has passed since the filing deadline.

If the individual fails to file their tax return by the relevant deadline, the penalty is initially £100. This penalty applies even if there is no tax to pay or if the tax due is paid on time. However, if the return remains outstanding after three months, additional penalties start to accrue.

After three months, a daily penalty of £10 per day will be charged, up to a maximum of 90 days (totaling £900). After six months, a further penalty of 5% of the tax due or £300 (whichever is greater) will be added. If the return still remains outstanding after twelve months, an additional 5% or £300 penalty will be charged.

It is important to note that there may be further penalties and interest charges if the failure to file the tax return is considered deliberate or as a result of carelessness. Additionally, penalties can be appealed against if there are reasonable grounds for the late filing.

It is recommended to consult with a tax professional or refer to the UK government's guidelines for specific information and advice regarding late filing penalties.

How do I execute section 48 template 2018-2024 online?

Filling out and eSigning section 48 template 2018-2024 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I sign the section 48 template 2018-2024 electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I complete section 48 template 2018-2024 on an Android device?

On Android, use the pdfFiller mobile app to finish your section 48 template 2018-2024. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your section 48 template 2018-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Section 48 Template 2018-2024 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.