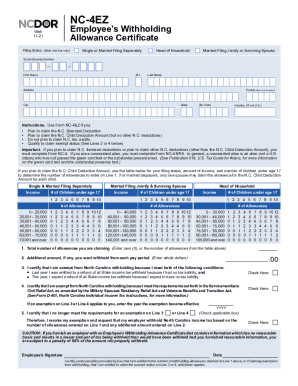

NC DoR NC-4 EZ 2014 free printable template

Get, Create, Make and Sign nc4 2014 form

Editing nc4 2014 form online

NC DoR NC-4 EZ Form Versions

How to fill out nc4 2014 form

How to fill out nc4 2014 form?

Who needs nc4 2014 form?

Instructions and Help about nc4 2014 form

Damon you to check here local CPA where we reduce liabilities and increase tax returns what I'm going to do here is I'm going to explain the new NC for easy form that needs to be completed prior to the end of 2013 this is going to affect your paycheck if you do not submit this form to your employer then what you need to do what they're going to do is they're going to spoil you set your payroll up so that your filing has a single and with no allowances and what that means for you is that more North Carolina income taxes will be withheld from your paycheck that's a maximum amount that can be withheld so if you're used to having a number of children and are married filing jointly I would see a lower paycheck as a result of this, so now I'm going to go through the NC for easy right who should fill up the NC for easy department revenue is saying that this is going to be a simpler form for most employees those that should use a form would be individuals that are claiming a standard deduction for North Carolina or that plan not to claim tax credits or if they're going to get credits for the children that would be the only one they're doing if for instance you're going to claim exempt status or if you print perform prefer not to complete the completed NC 4 if you do fill out the NC for easy you can still get your itemized deductions when you file your tax returns but what probably is going to happen is you may end up having more income taxes withheld North Carolina income taxes withheld from your paycheck so whenever you get a paycheck your paycheck would be a little lower than if you went through the whole to form so let's take a look at the NC for easy all right so as you can see here at the top of the form it says NC for easy and this is the employees withholding allowances this basically tells North Carolina your employer and your payroll provider how many taxes should be withheld from your paycheck each payroll period, so it's pretty, pretty self-explanatory they called it easy for a reason, so you're going to fill out your social security number here your marital status be single head of household or married call or qualified widower then you can fill out your first name middle initial and last name you're going to write in your dress the county here, and it does say enter the first five letters, so they're Mecklenburg County for instance you would only put fill out the first five letters in Mecklenburg your city state and zip and count country alright so again right here they're saying it's very important that you submit this before the beginning of the new tax year and then again right here these are just instructions that say who you should be filling out that NC for, so you can read through that, so now we're getting down to the number of dependents that you would be able to claim now we're going to move to the middle part of the form here and so this is where you are going to claim the allowances that you want to claim you do have the option...

Fill form : Try Risk Free

People Also Ask about

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your nc4 2014 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.