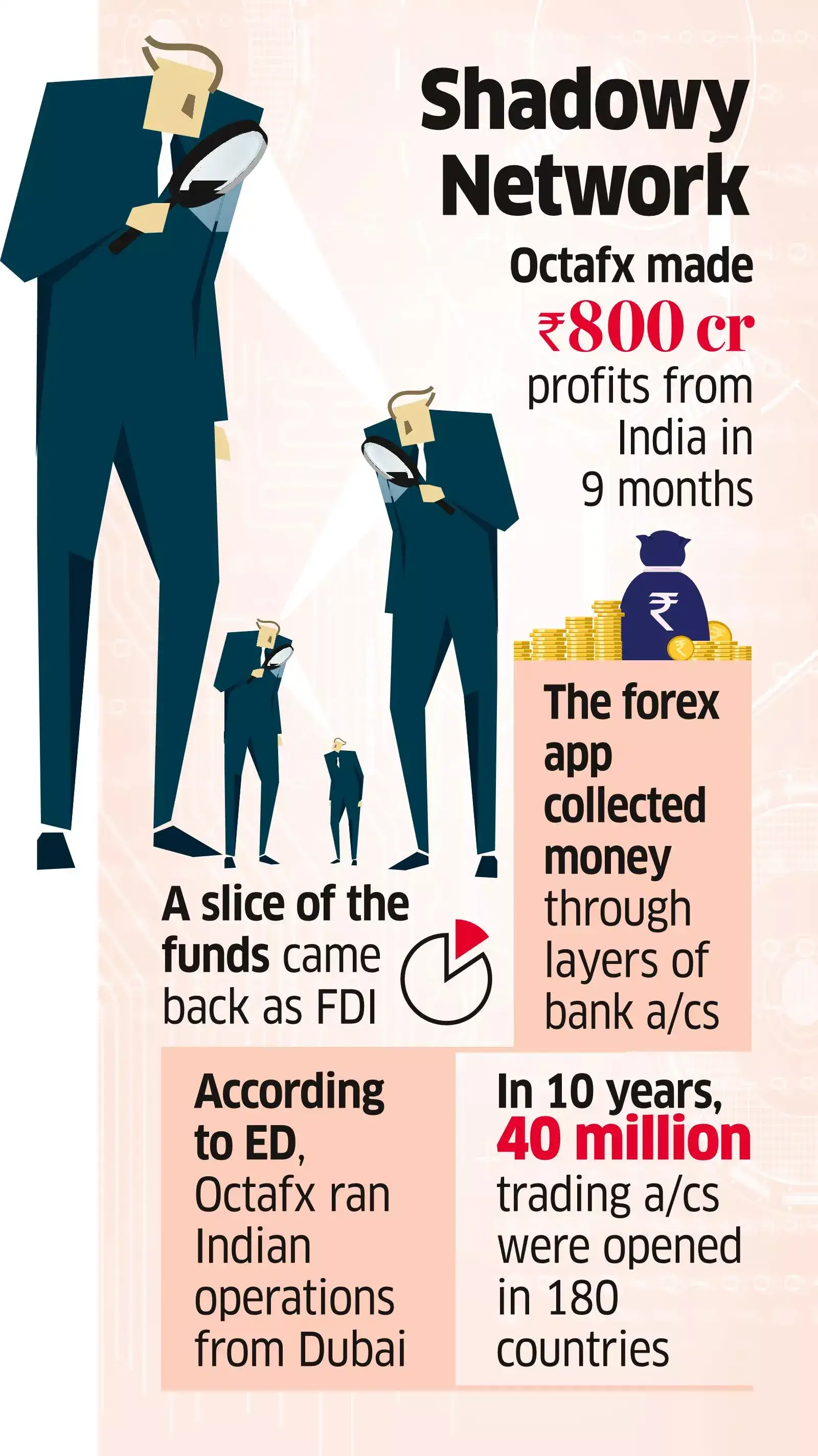

Octafx raked in profits of about ₹800 crore from India in just nine months in 2022-23.

Blacklisted by Reserve Bank

In the course of the probe, the ED found out that Octafx had used some of the alternative investment funds (AIFs) regulated by the Securities and Exchange Board of India (Sebi) to launder money, sources told ET. AIF is the regulatory term for domestic pooled investment vehicles like private equity and venture capital funds.

The LR, initiated in August, is a letter of request backed by a local court, for the assistance of Spanish authorities to obtain key evidence stored in the Octafx servers in Barcelona. Issued under section 57 of the Prevention of Money Laundering Act (PMLA) to establish the money trail, the LR is a precursor to the filing of the prosecution complaint before the PMLA Special Court expected on October 4.

Octafx, which has been blacklisted-along with other smaller foreign exchange trading apps-by the Reserve Bank of India, had sponsored an Indian Premier League team and hired soap opera stars as well as social media influencers to popularise the app and pull off a trading racket that allegedly stacked the odds heavily against unsuspecting traders.

ETMarkets.com

ETMarkets.comOPPOSITE TRADES

According to the ED's findings, once a trader placed a 'buy' order, the broker countered it with a 'sell' order, causing the particular exchange rate to fall.

This forced traders to close the position to avoid further losses and enabled the broker to book a profit.

Thanks to absurdly high leverage of 1:100 or even 1:500 offered on the Octafx app-indicating the ratio of the margin money chipped in by traders and the extent of borrowed funds-panicked traders exited when the rates moved against them. The ED suspects that clients' funds were not credited to trading accounts in the international market.

"These offshore platforms," said technology and gaming lawyer Jay Sayta, "do not comply with any laws of India and are said to have indulged in several dishonest and unethical practices including illegal transfer of funds received from the users on these platforms to the schemes' ultimate beneficiaries and kingpins who are located abroad. The modus operandi in collecting funds from the public through mule accounts and remitting profits abroad through hawala, cryptocurrencies or fake import invoices is not very dissimilar to illegal offshore betting platforms."

Indeed, money collected was allegedly transferred to Singapore as payment against "fake import of services."

"However, as we have seen in other cases as well, making the kingpins face the consequences of the laws of the land in India and getting evidence about such crimes from foreign authorities and/or courts is an extremely lengthy, complicated and time-consuming process. It will require persistent efforts on part of the authorities to ensure that the key people are brought to book and the case is not closed with action against low-level operatives," said Sayta.

From generous promotional expenses to collecting and remitting funds-a slice of which (more than ₹17 crore) came back as foreign direct investment in the local entity Octafx India-the group took various measures to cover its tracks.

According to the ED, Octafx hired retired bankers to train staff to handle queries from law enforcement agencies and traders, ran the Indian operations from Dubai, engaged Indians abroad to build trust, incentivised traders with gifts and encouraged them to act as "introducing brokers".

Also, it frequently changed local bank accounts and as more traders were allured to the platform, it increased the minimum cash deposit amount.

Octafx did not respond to ET's email queries till time of going to press.

Founded in 2011, Octafx offered trading in commodities and cryptos besides forex. In India, it had its first brush with the law in December 2021 when an FIR was registered by Pune police. A charge-sheet was filed in March 2022 for violation of the Indian Penal Code following which a case was recorded in December 2022 under PMLA. After the ED conducted a search, Octafx India changed its name to Tauga Private Limited.

(What's moving Sensex and Nifty Track latest market news, stock tips, Budget 2024 and expert advice, on ETMarkets. Also, ETMarkets.com is now on Telegram. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds .)

Subscribe to The Economic Times Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

Read More News on

(What's moving Sensex and Nifty Track latest market news, stock tips, Budget 2024 and expert advice, on ETMarkets. Also, ETMarkets.com is now on Telegram. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds .)

Subscribe to The Economic Times Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

Get Unlimited Access to The Economic Times

Get Unlimited Access to The Economic Times